Usually it’s on-brand to chat about my personal relationship with a game. I don’t review them because of their mere existence. There has to be some hook to get my interest, and this hook could be something simple like the genre or an intellectual property that entraps me in nostalgia. I also enjoy formatting my reviews with a top-down approach to get you, the reader, comfortable before diving into details.

But what can I truly say about this game that hasn’t been stated before? Hailing from the 1960s, an era preceding the digital reign of Atari, the imaginative realms of Dungeons and Dragons, and even my own inception by several decades, Acquire stands as a testament to the timeless essence of board gaming. It has served as a wellspring of inspiration for iconic designers like Reiner Knizia and Wolfgang Kramer, sparking the development of renowned games like Big Boss and Tigris & Euphrates.

Even in the nascent days of the internet, the corridors of Usenet echoed with passionate debates on Acquire’s intricate strategies and the perpetual question of its game balance. With a game equipped with a rich heritage, am I even allowed to criticize it? Is Acquire the Giovanni’s Room of Board Games?

Decisions, Deals, Dominance

I’ll let that question marinate your mind for a bit, but like Giovanni’s Room, Acquire has a story to tell, and it’s one that you are likely familiar with. You have money, you want more of it, and you get more through investments. Instead of buying real estate properties and collecting rent like Monopoly, you are founding, expanding, and merging hotel chains. All this activity is done by placing tiles on a grid, representing not only the expanding size of these chains but also their market dominance. After placing your tile, you can immediately buy stocks from active companies on the board.

However, unlike the actual stock markets, you can’t sell your stocks freely. Only during an acquisition period is there a brief window where players can liquidate their stocks, and it’s only the stockholders of the smaller company being gobbled up that have this opportunity.

That’s a basic overview of the game, and it’s time we get into more details. How does one go through a turn? Quite simple. You place a tile, you can buy up to three stocks of any active company, and draw up to your hand of six tiles. It’s a turn structure so smooth that you can taste the butter.

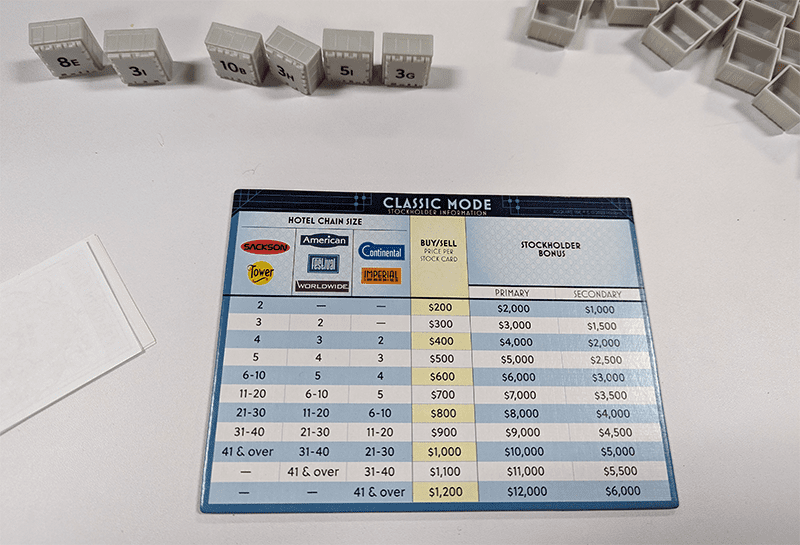

Acquire’s complications stem from the tile placement. Place a tile on its lonesome self, and nothing happens. If a tile is placed next to another tile that isn’t connected to a company, congrats, you have founded a company and your reward is a free stock along with the world’s quietest handclap. Placing a tile connecting to an existing company expands it, increasing the stock price of the company and, more importantly, the shareholder bonus when a merger occurs.

Insider Trading

Mergers happen when someone places a tile that connects two or more companies together. The larger entity, indicated by having more connected tiles, will assume control of the smaller one. Shareholders of the smaller company can choose to either sell a portion of their shares or opt for a 2-for-1 share exchange with the larger company, or keep their shares in case the company gets founded again.

Prior to any sales, a shareholder bonus is distributed. The player holding the greatest number of shares receives a cash payout, as does the second-highest shareholder. What makes the shareholder even more intriguing is that there is a final payout at the end of the game, meaning players are trying to get their hands in the right pockets while competing for the majority shareholder position for the larger companies at the end of the game.

The game concludes under one of two conditions: either all active companies on the board reach a secure size of 11 or more, or a single company has 41 tiles. Shareholders receive their shareholder bonus payouts for the shares they hold, followed by a universal sale of shares. The player with the most money is the victor.

In a perfect world, Acquire would be sitting in everyone’s household with ten thousand variants and obnoxious intellectual properties, while Monopoly would’ve been left as an interesting footnote in board game history. Unfortunately, the reverse happened.

Acquire is one of those few old games that has aged far more gracefully than the finest of wines. I can easily point out that this game is easier to teach than Monopoly while still preserving a competitive edge that remains sharp to this day. The game’s inclusion in the 2023 event of the World Series of Board Gaming, the pinnacle of competitive board gaming, is a testament to its enduring appeal and strategic depth.

Mastering the Deal

Why wouldn’t it? Acquire demands players navigate the volatile landscape of the stock market, construction, and mergers in their quest for a fat wallet. To do this, you have to depend on a bit of luck, a bit of skill, and a bit of social engagement to get the upper hand. The replayability doesn’t come from a deck of cards with a bunch of words—it comes from the unpredictable human beings at the table.

A simple examination of your hand of six tiles demonstrates this. Each tile is unique and goes to a particular space marked on the board. Only you have this information, and much like a proper US Senator, you are going to leverage this insider information to get those stacks of paper money. That 7G tile can create a new company, giving you a home field advantage when it comes to the shareholder bonus. The 10I tile can merge the two biggest companies in the game, so spending a few turns acquiring stock can help before you play it. While all of this sounds great, you also have to take into consideration information you don’t have, and that’s where you need to pay attention to other players.

A notable feature of Acquire is its emphasis on communal dynamics among players, shaping the game’s trajectory. Players collaboratively nurture each other’s companies, invest in each other’s stocks, and instigate mergers, often causing significant shifts akin to the dynamic movements of tectonic plates. Vigilance becomes paramount, and you must capitalize on momentum while deciphering the motives of your opponents.

After all, why is Kyle buying more Sackson shares? Does he plan on merging or growing that company? It is the mastery of these intricacies that evokes the sensation of navigating an endless stream, ensuring that comfort remains unattainable throughout a session.

Based on that description, you might get the impression that Acquire is the perfect game, but it isn’t. No game is perfect, and Acquire isn’t an exception here.

Read the fine print

I’ll start with the easiest criticism: player scaling. Acquire technically works at the five or six player count, but a myriad of issues fester all over the experience. Downtime becomes far more significant and can lead to the game hitting the two-hour mark. I love Acquire, but this isn’t a two-hour experience.

Perhaps the biggest issue with higher player counts is the shareholder bonuses. In the Classic mode, only two players will get the payout, making turn order a significant factor in one’s success. There is a Tycoon mode that gives three tiers of shareholder bonus payments, but the solution goes as smoothly as amputating your arms for weight loss purposes. It does fix the turn order issue a tad bit, yet you are still chained by the downtime. Don’t go with more than four players. There is a reason why the World Series of Board Gaming capped their Acquire games at four players.

While player count is something you can control, pacing is a whole other issue that is woven into the fabric of Acquire. Inconsistency is the word of the day here. I’ve been in games where mergers were happening within the first few turns, transforming the experience from riding the wave to surviving a tsunami. I’ve also experienced the other side of the spectrum, where three neighboring companies that were one tile away weren’t merged for the first forty minutes of the game.

Punching the Clock

Why? The players holding those tiles didn’t have any reason to play them since they didn’t have any shares. Unlike its little brother, Big Boss, there isn’t any incentive to merge or grow companies unless you have shares in them. This can lead to gameplay being so dry that I felt compelled to offer Acquire a chapstick.

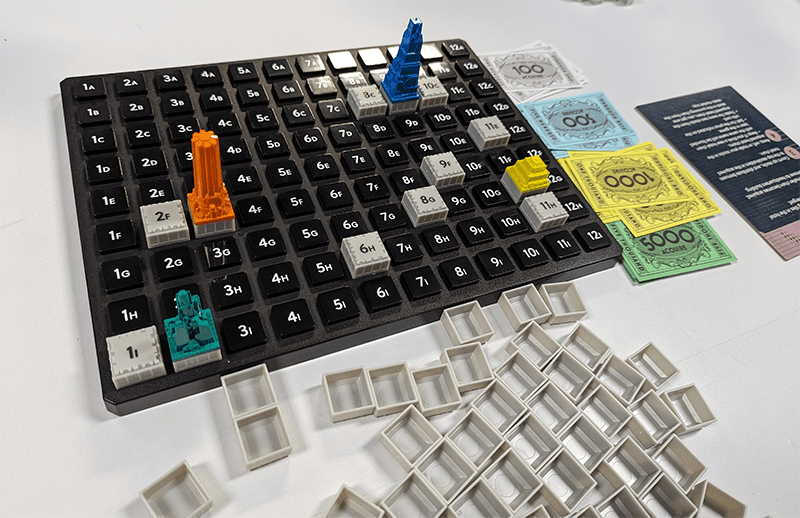

Naturally, an important concern many players would want me to address is whether this version is an improvement over its predecessors. In short, the answer is a resounding yes. As much as I adore my 1999 Avalon Hill edition of Acquire with its beautiful white box edges, this version is outright better. It successfully retains the plastic elements of the 1999 version, but without the cumbersome bulk, while staying true to the minimalistic charm of the original 1963 release. The stock cards are linen, the payout boards are thick, the rulebook is solid, and the inclusion of the player aid is welcoming. The only complaint I have is those silly orange flags that the rulebook insists you use for the company buildings, which, as you can tell based on the photos, I didn’t bother to use.

Nevertheless, Acquire remains a timeless gem among board games, seamlessly blending communal dynamics with strategic depth. With its improved components and quality of life elements, this new version elevates the Acquire experience while preserving the essence that has captivated players for decades. While minor issues might surface, they fail to overshadow the perpetual suspense and constantly shifting landscape that solidify Acquire’s reign as a cornerstone in the realm of classic board gaming.

Acquire is a long-time favorite of mine. I have an older ‘bookshelf’ edition, and purchased on of these for a friend. He loves the game as well.

Your criticisms are spot on. Cannot agree more. Wonderful review.

I have to ask though: have you tried MEGAcquire or MEGAcquire Gold? I have the Gold version and my friends and I have had a blast with it.

I have not tried them, although I have seen the game once in public.